Tax

-

-

Marketed as an alternative to traditional nicotine, 6-methyl nicotine is drawing growing concern from public health authorities in countries across the European Union ...

-

This report provides a detailed analysis of the regulatory framework in place for e-cigarettes in Canada, covering all policy areas from taxation and advertising to market access and packaging ...

-

Bill increasing taxes on tobacco and nicotine products signed into law...

-

House approves tax increases, though only for cigarettes...

-

Bill increasing tax on tobacco and e-liquid has been introduced...

-

Increase in e-liquid tax comes into force 1st July...

-

Seimas returns e-liquid tax bill for improvement...

-

The European Commission is reportedly planning significant tax hikes on e-liquids, nicotine pouches and heated tobacco products, based on a leaked impact assessment ...

-

Shura Council asks ZATCA to reconsider importer/exporter ‘financial burdens’...

-

This report provides a detailed analysis of the regulatory regime in place for e-cigarettes in Switzerland, covering all policy areas from taxation and advertising to market access and sanctions ...

-

Ministry of Finance wants 3% flat tax on some imported items...

-

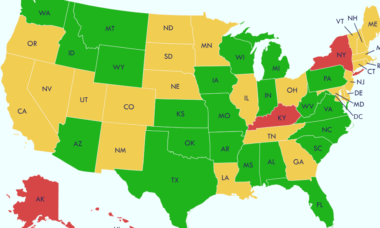

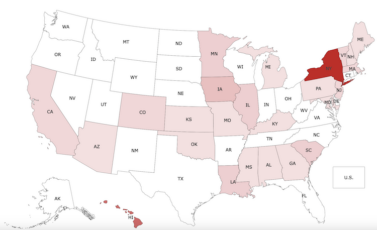

This regulatory tracker, updated quarterly, focuses exclusively on enacted US state law (federal and local law are not considered) ...

-

RIVM recommends increased excise taxes on e-cigs...

-

Bill that would increase taxes on vapour products heads to governor...

-

This report provides a detailed overview of the regulatory framework currently in place in Ukraine for e-cigarettes, covering all policy areas from product and packaging restrictions, to advertising and taxation ...

-

Parliament approves 2025-2026 budget...

-

Last November, the feeling was that the election of US president Donald Trump indicated a general shift to the right in global politics, but the results did not quite pan out that way ...

-

Public consultation open on e-liquid excise tax hike...

-

Leaked impact assessment says EU Commission to hike vape taxes...

-

Customs clarifies price adjustments on imports...

-

This report provides a detailed analysis of the current regulatory framework in place in France for e-cigarettes, covering all policy areas from advertising and market access to taxation and packaging ...

-

Consumers’ union says proposed vape tax is too high...

-

ECigIntelligence's US state law regulatory tracker is updated quarterly and exclusively focused on state law. This interactive map allows you to zoom in and out of regions, and select multiple states to compare regulations ...

-

This report provides analysis on the e-cigarette regulatory framework in Vietnam, covering all policy areas from sanctions and market access to product restrictions and advertising laws ...

-

Bill introducing new nicotine definition and tax rates goes to governor...

-

Draft in progress to amend Excise Law to tax e-cigs...

-

New excise rates for e-liquids now in force...

-

Vape retailers repeat calls for tax exemptions...

-

MPs call for vape legislation and tax hikes...

-

This report offers a detailed analysis of the regulatory framework for e-cigarettes in Spain, covering all policy areas from product, age and packaging restrictions, to advertising, taxation and enforcement ...

-

EC plans to propose e-cig tax increase by summer...

-

Amendment approved to decrease retail tax on e-cigs...

-

Discussions held on tobacco tax policy...

-

Excise duties on e-liquids with and without nicotine to increase...

-

Social media video reiterates denial of VAT hike...

-

Deputy prime minister says tobacco tax income decreasing...

-

Senator opposes bill to cut tax on tobacco products...

-

Tax Authority denies rumours of tax increases...

-

Two surveys suggest flavour bans are the biggest potential changer of current vaper behaviour but that their implementation would not necessarily drive current vapers back to smoking ...

-

Senator opposes vape tax reduction...

-

This report provides detailed analysis of the current regulatory framework in place in Sweden for e-cigarettes, covering all policy areas from taxation and advertising to product restrictions and market access ...

-

Senator recommends single tax rate on vaping products...

-

Vape retailers call for tax rise exemption...

-

PECIA praises BIR actions against vape tax evasion...

-

New laws banning vending machine sales and taxing vape products...

-

New law sets tax framework for vapour products...

-

Goods imported from China to the US will see a 115% reduction in tariffs as of 14th May, but the abrupt, temporary change offers no real certainty for long-term business planning ...

-

This timeline of tariffs will be updated as further changes are made to the US tariff policy on Chinese imports or as new documents are added to the US Federal Register ...

-

EC to propose higher taxes for nicotine alternatives...